With today’s announcement that the owner of CYBG has agreed an acquisition deal with Virgin Money to the tune of £1.7bn, we are now looking at a takeover that will result in the UK’s largest challenger bank.

Challenger banks are often considered more innovative and agile than long-established major banking institutions. But is it possible for a challenger bank to remain agile as it grows, especially in the UK’s highly-regulated finance sector” Dr Simon Hayward, CEO of Cirrus and author of The Agile Leader, looks at some of the issues and suggests how organisations can remain agile as they evolve.

Why does agility matter?

Leadership Connections research from Cirrus and Ipsos MORI revealed agility as the number one priority for business leaders. There is widespread agreement that being agile helps you to achieve goals and react to new opportunities more swiftly and decisively. This means that today’s business leaders must assess and continually react to new opportunities and challenges. They need to implement strategies rapidly and refocus efforts when circumstances change.

Customer expectations in our digital age

Technology is fuelling the pace of change in our unpredictable and complex world. It has had a huge impact on the finance industry. The increasingly digital nature of customer interactions accelerates the expectations we have. Technology also enables organisations to respond to these expectations more effectively and to create more innovative solutions. If we look at the banking and finance industry, we can see that many challenger banks have been quick to seize the opportunities that technology presents.

Rather than trying to emulate the vast range of services that major banks offer, the UK’s diverse range of challenger banks tend to focus on carving out distinctive propositions in particular areas. The most successful are responsive to the changing needs of customers. Today, many of us are multi-bankers. 25% of UK banking customers have more than one current account and most of us will shop around for mortgages, loans and credit cards.

Can an organisation remain agile as it evolves?

It’s possible to continue being challenging, disruptive and agile as you evolve and grow. It can however be very challenging, particularly if you operate in a heavily-regulated industry such as banking and finance. At times, it can be difficult to balance the need for compliance with agile working. Another watch-out for CYBG and Virgin Money (and any evolving business) is the widespread tendency for organisations to introduce more systems and processes as they grow. During a takeover, it is well worth maintaining a focus on simplicity and avoiding complexity where possible.

Keeping things simple

One of the advantages of being a startup or challenger organisation is that you are usually unencumbered by legacy systems and processes. These can create a great deal of bureaucracy, which can stifle agility. Often, organisations find it hard to stop doing the things that they?ve been doing for a long time. The larger and longer-established the organisation, the more difficult this can become. Many activities continue because that’s what has always been done.

As time goes by, rules and procedures tends to become more complex, with more control adding extra layers to the labyrinth of bureaucracy. This is especially common in highly-regulated industries such as finance. Some organisations end up requiring an army to manage and maintain the rules and procedures. Leaders often feel like more of their time is spent managing risk than supporting the people around them. This slows down the organisation, restricting pace, innovation, and entrepreneurial flair. The need for simplification is clear, but the challenge is immense because the system is difficult to change.

If your organisation is growing and evolving, try and retain an obsession with simplicity and an intent on doing only what is necessary. I have witnessed some striking results during mergers, takeovers and other change situations when business leaders have encouraged colleagues to challenge every rule and process to see how it can be simplified and refined. This has helped to reduce the burden of bureaucracy across their businesses, ensuring process simplicity throughout periods of transformation.

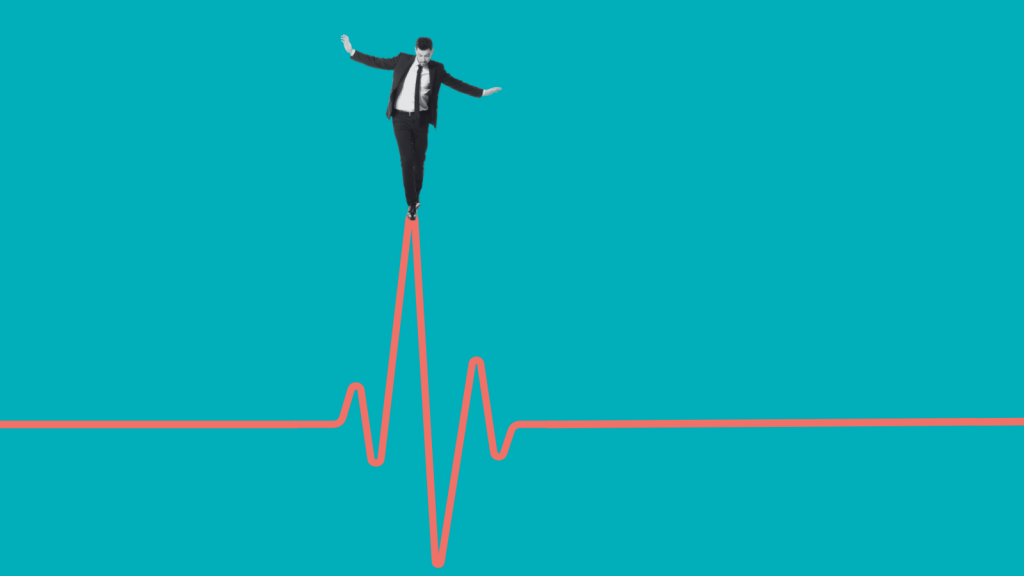

The agile leadership paradox

Many evolving businesses are faced with the paradox of agile leadership. In a takeover or merger situation, this involves creating a connected organisation while at the same time disrupting that new organisation sufficiently to reinvent it. Getting this balance right is critical if the new business is to compete on a sustainable basis with competitors. The principles of agile working need to be adopted across the entire business: greater emphasis on simplicity, shorter planning cycles, ruthless prioritisation focused on what customers want, and embracing digital opportunities.

The finance industry, like most industries, is becoming more and more complex and competitive. Whatever industry you’re in, a focus on agility will help ensure that you can innovate and respond to customer needs with speed whatever lies ahead.

Dr Simon Hayward is CEO of Cirrus and author of Connected Leadership and The Agile Leader.