Header Image Source: Pexels

Ensuring that everyone at your company gets paid accurately and on time is vital. Doing so impacts your team’s motivation, their perception of your company, and your legal compliance. However, manual payroll administration, either on-house or with an external service provider, can be time-consuming and error-prone, causing bottlenecks and delays in payroll operations.

The solution? Streamline your payroll operations by using advanced payroll tools. If you’re looking for the best tools for issuing payslips and employee salary payments automatically, you’ve come to the right place.

It’s important to consider tools with specific functionalities tailored to the intricacies of the UK tax and employment landscape, which can help ensure compliance with employment laws. A tool that takes UK payroll’s unique challenges into account is the ultimate HR ally, and the five solutions below all qualify in this regard.

A quick overview of payroll tools for the UK

Payroll tools are powerful software solutions that automate and streamline the payroll process. Payroll solutions designed to handle UK payroll regulations can deal with tax requirements and employment laws, ensuring accurate and compliant employee payment processes.

These tools typically offer functionalities that simplify payroll administration tasks, including automated generation of payslips, calculation of tax deductions, National Insurance contributions, and statutory payments such as sick leave and maternity pay.

Most can integrate with His Majesty’s Revenue and Customs (HMRC) systems, allowing businesses to submit regular reports and stay updated with the latest tax regulations and reporting requirements. Besides simplifying payroll calculations, payroll tools can provide features for managing workplace pensions, generating year-end reports such as P60s and P11Ds, and facilitating communication with pension providers.

Finding the best payroll tool can take time and research, but we can help narrow your search with the five tools to speed up your payslip generation and payments below.

1. Pento

Effective payroll management involves many moving parts that are time-consuming, resource-draining, and challenging to manage without the right tool. One of the leading payroll tools that can help you overcome these challenges is Pento.

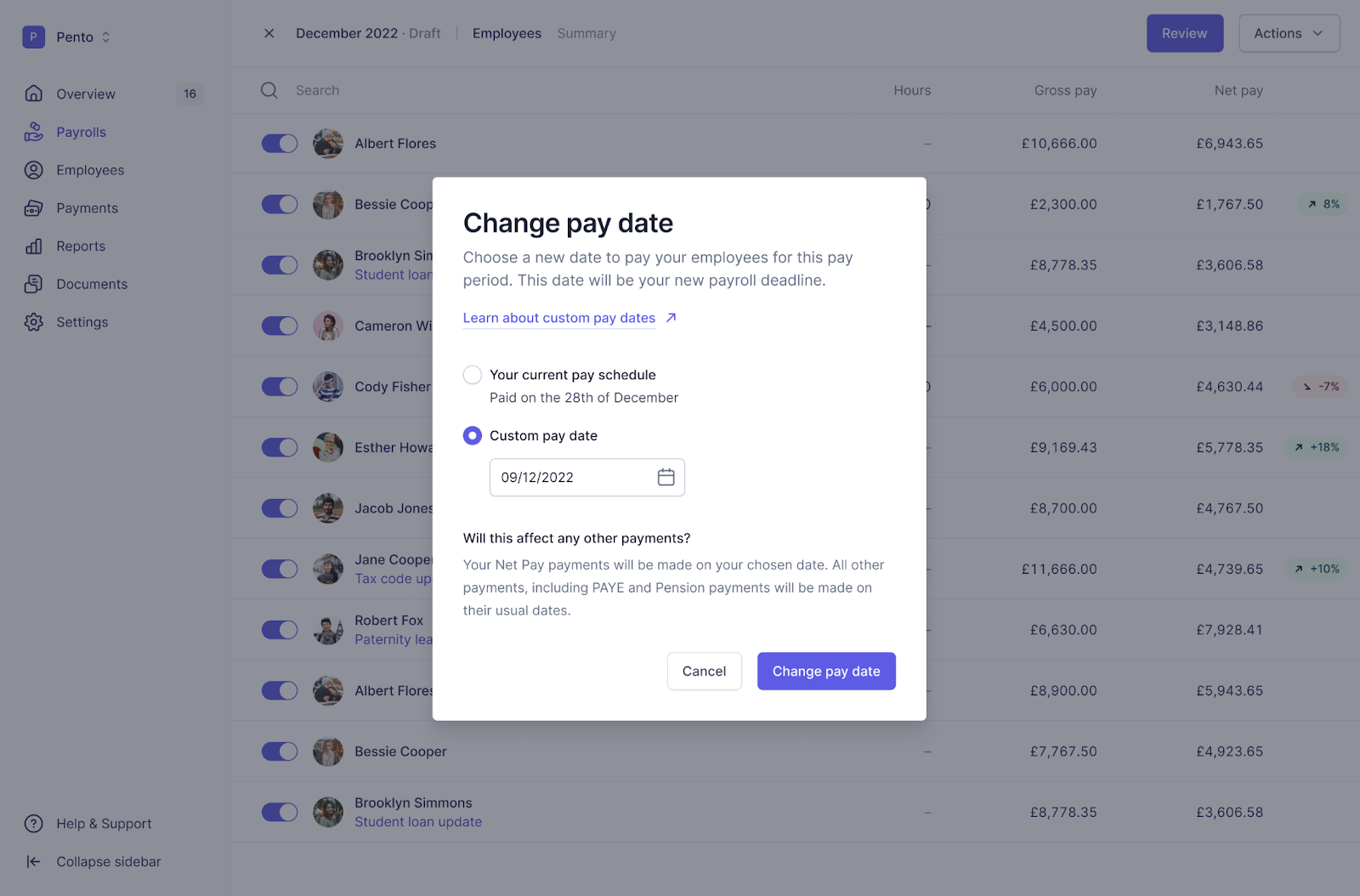

Pento is a feature-packed software platform with automated payroll tools. It can automatically make bank payments, calculate taxes, sync with HMRC and pension providers, and auto-enrol eligible team members for respective pensions.

It also syncs information with your other HR systems, such as CharlieHR, BambooHR, and Hibob, so you can minimise data entry and compliance issues by auto-updating employee details and then automatically making payments to HMRC’s PAYE system on time.

With its easy-to-use interface and tools, you can distribute paycheques and transfer money, generate reports to track changes and trends, and easily adjust employee salaries and details whenever you need to, right until the moment when you close payroll.

The payroll solution has a dedicated onboarding team to help you get started, and it offers continued support across multiple channels, including email, chat, and phone. While Pento does integrate with accounting tools, the platform itself is only for payroll, so if you’re looking for a comprehensive finance suite, this isn’t the option for you.

Pento’s pricing starts at £5 per employee per month, with a minimum monthly fee of £149, and you can reach out to learn more or get a more custom quote.

2. Xero

Xero is an accounting tech solution designed for small and medium-sized businesses. The software provides accounting and financial management tools to help streamline your business processes, manage finances, and collaborate with accountants or bookkeepers.

Xero’s main features and functionalities include the following:

- Payroll management to help you oversee employee wages, taxes, and compliance requirements.

- Invoicing and billing tools to create professional invoices and track payments. Xero also supports automated invoice reminders and recurring invoicing.

- Bank reconciliation options that connect your bank accounts to Xero, automatically importing and categorising your transactions for faster and more accurate reconciliation.

- Reporting and analytics tools to help you generate financial reports, track key performance indicators, and gain insights into your business’s performance.

- Integrations with many third-party applications, such as payment gateways, ecommerce platforms, and customer relationship management (CRM) systems.

While Xero offers payroll management tools, the solution may be overkill if you’re all set with a bookkeeping and invoicing solution and all you need is a reliable payroll tool.

Xero has a steep learning curve, and some say that it isn’t ideal for beginners and busy teams.

Xero’s pricing plans start at £14 per month, with a 50% discount available for the first six months, with applicable terms.

3. Moorepay

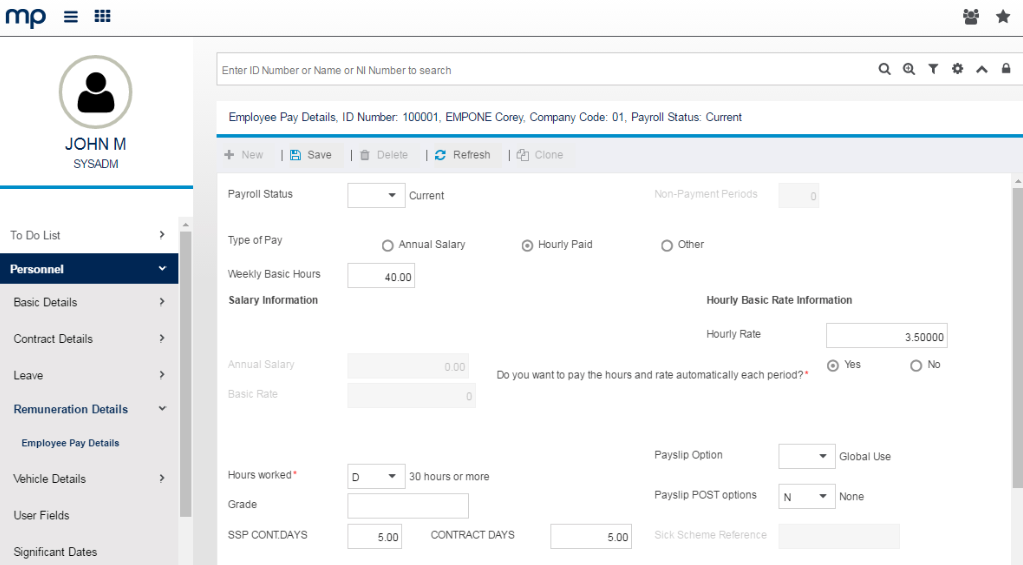

Moorepay is a hybrid solution that combines payroll tools, other HR solutions, as well as done- for-you services. It offers solutions to help you manage your payroll processes, comply with employment regulations, and streamline HR workflows and tasks.

You can choose from these Moorepay payroll options:

- Payroll software with automated pay, tax, and deduction, including OSP, SSP, SMP calculations, payslip generation, and full integration options with Moorepay’s HR software.

- Payroll outsourcing by entering your data into Moorepay’s payroll software, and its team of experts handle the rest, from producing accurate payslips to making timely HMRC payments.

While Moorepay is great if you want a hybrid solution, it can involve the usual issues when outsourcing payroll, such as inefficiencies due to long back and forths with your provider. And given how easy today’s advanced tools are to manage, many companies that used to use payroll bureau services have started “insourcing” instead.

Moorepay’s pricing isn’t as clear-cut as other payroll solutions, since the company seems to emphasise its full-service track and therefore doesn’t provide a single price point or generic package selection. You must answer a questionnaire from the Moorepay team, who then recommends a price point and service package for your approval.

4. Octopaye Payroll

Octopaye is a cloud-based payroll platform that offers multiple payroll models, such as umbrella PAYE, joint employment, multiple companies, and PEO/payroll bureau. This service provider and its platform is designed to run payroll for companies and recruitment agencies with many employees and usually handles irregular payment patterns.

The software can run thousands of simultaneous payments (and payment models) and manage multiple processes throughout various companies in one management portal. It can calculate and process internal payment administration and PAYE services.

Octopaye lets you tailor your access and dashboard to meet and deploy multiple payroll models efficiently. It can integrate with third-party systems, such as document management, banking, compliance, and pension providers, to streamline payroll administration. You can also rebrand your payslips and portals with your company colours and logo and access detailed reports.

Like most outsourced payroll services, as opposed to pure software plays, some may find it challenging to have complete control over payroll administration with Octopaye.

You need to contact Octopaye to receive custom pricing information.

5. PrimePay

PrimePay is an all-in-one payroll and HR platform that simplifies administration across the employee cycle, from hiring to retiring. The software can automate and integrate essential services and processes, including benefits, onboarding, and insurance disbursements.

PrimePay’s solution includes:

- HR management

- Self-service and done-for-you payroll

- Benefits administration

- Finance analytics

- Time and labour management

- Insurance and compliance

One downside to PrimePay is that it can take too long to complete and make reports available, slowing down your accounting processes. Some reports are also tricky to find and pull without support, and you could wait days before knowing if an employee hasn’t been paid. PrimePay also doesn’t offer weekend or nighttime support.

PrimePay pricing starts at under £50 per month.

Find the best payroll tool for you

Leverage the power of automated payroll tools to streamline the entire process of generating payslips and ensure that your team gets paid on time, every time.

These tools save you precious time and effort while reducing errors and compliance issues. Embracing payroll automation will undoubtedly revolutionise how you handle your payroll tasks. Invest in the right payroll tool today and unlock a seamless, hassle-free payroll experience for your company.